You are here:Bean Cup Coffee > news

Can I Cash in on Bitcoin?

Bean Cup Coffee2024-09-22 01:25:24【news】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the digital currency that has taken the financial world by storm, has sparked a debate amon airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the digital currency that has taken the financial world by storm, has sparked a debate amon

Bitcoin, the digital currency that has taken the financial world by storm, has sparked a debate among investors and enthusiasts alike. With its skyrocketing value and the promise of immense returns, many are wondering, "Can I cash in on Bitcoin?" In this article, we will explore the potential of cashing in on Bitcoin and the factors to consider before making an investment.

Firstly, it is crucial to understand that Bitcoin is a highly volatile asset. Its value has experienced dramatic fluctuations over the years, making it a risky investment. While some have made substantial profits, others have lost a significant amount of money. So, can I cash in on Bitcoin? The answer lies in your risk tolerance and investment strategy.

To cash in on Bitcoin, you need to conduct thorough research and analysis. Here are some key factors to consider:

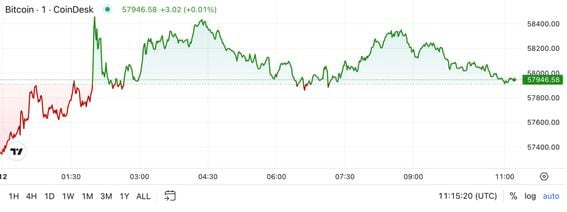

1. Market Trends: Keep an eye on the market trends and historical data to understand the behavior of Bitcoin. Analyzing past price movements can help you predict future trends, although it is not a foolproof method.

2. Market Sentiment: Bitcoin's value is heavily influenced by market sentiment. Positive news, such as regulatory approvals or partnerships with major companies, can drive up the price, while negative news, such as regulatory crackdowns or security breaches, can cause it to plummet. Stay updated with the latest news and developments in the cryptocurrency space.

3. Investment Strategy: Decide on your investment strategy before diving into Bitcoin. Are you looking for short-term gains or long-term investment? Short-term traders may focus on technical analysis and market trends, while long-term investors may consider holding Bitcoin for several years.

4. Risk Management: As mentioned earlier, Bitcoin is a volatile asset. Implement risk management strategies to protect your investment. This may include diversifying your portfolio, setting stop-loss orders, and not investing more than you can afford to lose.

5. Security: Ensure that your Bitcoin investments are secure. Use reputable exchanges and wallets to store your digital assets. Be cautious of phishing scams and other fraudulent activities that target cryptocurrency investors.

6. Regulatory Environment: The regulatory landscape for cryptocurrencies is still evolving. Stay informed about the regulations in your country and the potential impact on Bitcoin's value.

Now, let's address the question, "Can I cash in on Bitcoin?" While there is no guaranteed way to predict the future of Bitcoin, many investors have successfully profited from it. However, it is essential to approach Bitcoin with a well-informed mindset and a realistic expectation of potential returns.

In conclusion, if you are considering investing in Bitcoin, it is crucial to conduct thorough research, understand the risks involved, and develop a sound investment strategy. While the possibility of cashing in on Bitcoin exists, it is not without its challenges. Stay informed, manage your risks, and make informed decisions to increase your chances of success.

Remember, "Can I cash in on Bitcoin?" is a question that only you can answer based on your financial situation, risk tolerance, and investment goals. With careful planning and due diligence, you may find that Bitcoin can be a valuable addition to your investment portfolio.

This article address:https://www.nutcupcoffee.com/btc/57c69599247.html

Like!(625)

Related Posts

- Clsk Mining Bitcoin: A Comprehensive Guide to the World of Cryptocurrency Mining

- Bitcoin Price December 2011: A Look Back at the Cryptocurrency's Early Days

- What is the best Bitcoin Cash management platform?

- October 2017 Bitcoin Price: A Milestone in Cryptocurrency History

- Calculate PC for Bitcoin Mining: A Comprehensive Guide

- What Happens to My Bitcoin Cash During the Fork?

- Are Bitcoin Mining Companies a Good Investment?

- Bitcoin Cash Software Download: A Comprehensive Guide

- Binance USD Withdraw: A Comprehensive Guide to Secure and Efficient Transactions

- Binance Smart Chain Discord: A Hub for Blockchain Enthusiasts and Developers

Popular

Recent

Bitcoin Machines in Canada: A Growing Trend in the Financial Landscape

What Price Did the Winklevoss Twins Buy Bitcoin At?

What Happens to My Bitcoin Cash During the Fork?

How to Move BTC from Binance to Coinbase: A Step-by-Step Guide

Can I Invest $10 in Bitcoin?

NFC Bitcoin Wallet: The Future of Digital Currency Transactions

Bitcoin Top Wallet Holders: The Power Players in the Cryptocurrency Landscape

Binance Fees to Withdraw: Understanding the Costs and Strategies for Efficient Transactions

links

- Bitcoin Price Prediction 10 Years: A Look into the Future

- Binance Chain Network Metamask: A Comprehensive Guide to Interoperability and Accessibility

- Guy Forgets Password to Bitcoin Wallet: A Cautionary Tale

- The Rise of XRP Binance Smart Chain: A Game-Changer in the Crypto World

- Title: Simplify Your Cryptocurrency Exchange with Convert Coins in Binance

- What Was the Bitcoin Price When It Started?

- Small Market Cap Crypto on Binance: A Hidden Gem for Investors

- Bitcoin Price Chart 2016-2017: A Journey of Volatility and Growth

- Title: Exploring Canadian Bitcoin Wallets: A Comprehensive Guide